The top 10 blockchain trends for 2021

These 10 blockchain trends will take center stage in 2021. From DeFi to IOTA to supply chain, there are many solutions.

Blockchain Trends 2021 focuses on transparent supply chains, smart contracts, central bank money, crypto assets, and decentralized exchanges.

The current year promises exciting projects as recent large investments pay off in real-world applications and concrete solutions. Motivated by past successes and the promotion of blockchain technology, an interesting market picture of startups, global players, and SMEs is forming.

Top 10 Blockchain Trends 2021

No one looking at blockchain in 2021 can avoid these trends. What’s new is that blockchain interoperability has gotten

better, and vendors have significantly stepped up their efforts in this area.

This may also be since competition has increased, as there are now almost 30 blockchains on the market. The numerous service providers for Blockchain-as-a-Service, for example, and developers for decentralized applications on the Blockchains, the Dapps.

Blockchain Trends 2021 are also influenced by the high number of startups. Especially in Berlin, an interesting scene of young entrepreneurs is emerging, with considerable financial support from well-known backers.

Supported by foreign investors and promoted by nationwide awards in competitions or hackathons, a new mecca for IT, software, digital technologies, and blockchains is emerging in the capital.

Development of IOTA and Hyperledger in 2021

Along with Hyperledger, IOTA is a promising candidate for standardized applications for industry. Transparent supply chains characterize global production chains, and value creation is increasingly becoming the focus of companies.

Starting with customers and consumers’ changing demands, the focus is often on user convenience and product quality. Mass-produced processes are becoming less important, as individuality and sustainability have led to a rethink in society.

With their different solutions, both companies address these requirements and are thus part of Industry 4.0. Hyperledger works alongside the financial sector in supply chain management and is linked to Ethereum in many enterprise platforms.

IOTA, on the other hand, focuses on machine economics and data stream processing. IOTA’s industrial marketplace contributes to the autonomy of data in the Internet of Things.

Both providers focus on digital transformation and the development of value-added applications for industry and commerce. Hyperledger and IOTA are, therefore, clearly among the most important Business Blockchain Trends 2021.

1. Supply chain optimization

Optimizing supply chains should actually be self-evident from a business perspective. However, there are many hurdles, especially in the area of goods flow and logistics. The industries are known for their paper-heavy processes and struggle with many challenges in day-to-day business.

In the case of international goods traffic, it is often a wide variety of systems, manual work, and cross-border specifications that make the work of logisticians and partners more difficult.

Optimized supply chains do not just refer to the cost-optimized shipment of good or raw materials from A to B. Because of digitization and the desire for transparency in all processes, a uniform system is needed that can map each good as a digital twin and store it permanently in a secure, distributed database.

Long distances, many partners, large volumes of documents and data, and mutual trust can be optimally mapped digitally with blockchains.

As a distributed ledger, the technology is ideally suited to recording and storing large volumes of data and granting access to every single detail to a predefined target group. All transactions that take place are stored on the central ledger.

Through various applications, raw materials can be tracked from their origin and grant digital certificates the authenticity or accuracy of information and documents.

The integration of DLT in supply chain management is one of the top blockchain trends in 2021 because, on the one hand, the consumer’s need for transparency is growing. On the other hand, the barrier-free supply of goods across all borders ensures greater security and economic stability.

Hyperledger is particularly noteworthy here. With Sawtooth, a blockchain platform is available from the Foundation that connects all value chain participants.

IOTA price forecasts 2021 to 2035: Will IOTA manage to make a comeback?

2. Introduction of CBDCs

Digital central bank money was already a big topic in 2020. This was also due to the suddenly emerging strategy of the ECB and the apparent sympathy of Christine Lagard, who could now imagine digital money issued by the central bank after all.

While China wants to play a pioneering role worldwide in central bank money, the Central Bank Digital Currencies (CBDCs) , Europe has so far taken a rather cautious, if not downright dismissive, approach to the issue. China already has a digital e-yuán controlled centrally by the government, not in the true sense of decentralized blockchain technology.

The sudden change of heart at the European level may have come about due to the announcement by a private-sector company to launch its own digital money.

Startled by Facebook’s vision of Libra, digital money institutions obviously came under pressure.

If digital money is to be used, then digital money is controlled by the central bank. At least, that is the wish of those in charge. Financial sovereignty lies with the central banks and thus with the state, and they want to keep it that way.

The fear of a decentralized system seems to be great. In the ECB, there is at least a strategy for a centrally managed, digital euro. Blockchain could be considered for implementation, but this does not seem certain at all so far.

There are still many uncertainties, but central bank money is definitely one of the Blockchain Trends 2021 because it is only a matter of time before digital money becomes mass adoption.

3. DeFi adoption on the rise

Decentralized financial transactions are increasingly gaining acceptance over their centralized variants. As a classic counter-movement to the market around stocks, funds, and returns, blockchain provides numerous approaches. Decentralized finance also enables private small investors to enter the financial world, turning millions of people into investors.

Decentralized investment is based on buying coins and lending them to third parties. This is done through loans, interest, or decentralized exchange organizations. The instruments come from the classical field, but the technology is based on the blockchain.

The programmable money can be used for a variety of profitable transactions. In lending, a user lends his or her coins to a third party and receives interest.

In borrowing, a user borrows Coins, pays interest, and must post collateral. The exchange of cryptocurrencies is called a decentralized exchange. Trading is where complex financial transactions can be mapped, such as options or futures.

Liquidity mining describes the acquisition of tokens that can be exchanged for voting rights or equity interests later.

Many of the DeFi sector applications are currently based on Ethereum and offer barrier-free entry options, which is why there is often talk of Open Finance.

What is DeFi? The ecosystem behind Decentralized Finance explained

4. Certificate verification via the blockchain

The validity and timeliness of certificates is the basis for trust between business partners. The digital security of the Blockchain supports companies in their compliance efforts and adherence to rules and standards.

Certificates using blockchain technology are tamper-proof and can be viewed transparently by every participant in the network. Providers of these solutions thus ensure that audits and certification, for example, can be carried out successfully. However, the digital certificates can also be proof of ownership or proof of origin.

“Putting our certificates on the blockchain is the first step in building a new digital assurance concept. Our goal is to use Blockchain and other disruptive technologies to offer new services and continue to create value for our customers,” says Renato Grottola, Director Global Digital Transformation at DNV GL — Business Assurance.

Source: www.deloitte.com

Currently, numerous providers can be found that are primarily concerned with certifications within the framework of DIN ISO standards. This is because the abuse of these certificates has steadily increased in recent years. By checking the documents and then entering them on the Blockchain, companies ensure that they are authentic and cannot be used forgeries.

The Ethereum Blockchain is ideal for this purpose and has already proven itself well for the secure, transparent, and independent documentation of management system certification. Once stored, anyone can access the relevant information with a QR code, ensuring efficient processes and user convenience during audits.

Digital certificates are a blockchain trend 2021, as they prevent misuse and provide consumers and partners with security for future business relationships.

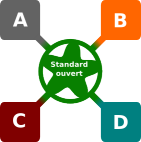

5. Improved interoperability between blockchains

If programs, systems, or technologies act among themselves without restrictions, then it is called interoperability. It assures users that systems can be exchanged regardless of the manufacturer.

Blockchain interoperability is at the top of the list of technical innovations for many well-known companies. Accenture, IBM, SAP, Oracle, Microsoft, and Fujitsu are just a few of the global players working on using blockchains without barriers.

The various blockchains are all more or less further developments of the Bitcoin Blockchain, but there are significant differences that prevent seamless working so far.

The differences are still most apparent in the limited options for combining the platforms or connecting them across interfaces.

However, this would make things much easier for blockchain developers. A basic framework for the rapid transfer of assets, for example, could streamline processes.

Interoperable blockchains enable seamless information transfer and data exchange. They can then be easily inserted into existing systems and can initiate transactions in other networks.

That’s as far as the theory goes, as work is still underway to achieve standardized interoperability of blockchains. Major hurdles are also apparent in old IT systems in companies, which must first be modernized.

6. Battle of the smart contract blockchains

Those who use blockchains are interested, among other things, in their great transparency. But the real advantage of data chains lies in the execution of trustworthy transactions between partners.

Digital contracts, or smart contracts, are fueling the economy and have led to great projects and platforms so far. First and foremost, the Ethereum Blockchain specializes in the use and development of fast and secure contracts based on computer protocols.

Here, the contracts can be executed anonymously and without an intermediary based on logic, just like the platforms and providers Polkadot, Near, Dfinity, and of course IOTA. However, automatic contract execution has its limitations (so far).

These include situations where the digital contract lacks information on the blockchain, such as an exchange rate. Besides, mistakes made when programming the code cannot be revised, and the error could thus propagate through entire systems.

At Polkadot, the developers around the former CTO of the Ethereum project, Gavin Wood, are addressing the weaknesses of existing systems. The platform cannot yet handle its own smart contracts. Still, with the Moonbeam Network, there is a connection to the EVM and, via Solidity and Viper, the possibility to develop their own smart contracts based on Ethereum.

This shows the great efforts of the industry and why smart contracts are a blockchain trend in 2021. By the way, since the end of 2020, the IOTA network can also handle smart contracts.

Polkadot forecast 2021 to 2025. This is how Polkadot (DOT) could develop medium.com

7. DEXes gain market share

Prospective buyers and sellers of cryptocurrencies come together via exchanges. The centralized entity usually offers participants the possibility of direct P2P payment. Decentralization means the exclusion of a third entity in the transactions. Because there, the customers’ funds would be with central exchanges and banks.

But with the so-called DEXes, decentralized exchanges, Decentralized Exchanges, an automated system based on blockchains enables trading directly between users.

Crypto Exchanges

Decentralized exchanges represent the counter-movement to the traditional financial market. They are private in nature, which is not without risk, and operate more confidentially, as a user’s personal data only goes to the person they sold to or bought from.

The hosting of crypto exchanges is the responsibility of the nodes present in the network in a distributed manner. There is a step-by-step guide “Buying cryptocurrencies” on our site.

Uniswap is based on Ethereum and is controllable via a decentralized app. It belongs to the field of Decentralized Finance. The crypto exchange allows the automatic exchange of ETH and other Ethereum tokens via smart contracts.

Uniswap is exceedingly popular, and that’s partly because users can add Ethereum tokens as liquidity and get a 0.3% return on transaction fees. It is controlled via a wallet.

DEXes are definitely one of the blockchain trends in 2021, as the traffic and trading volume of existing providers is increasing month by month. While currently the only truly decentralized exchange is Uniswap, other promising providers such as DeFiChain or Dodo are ready. So it remains exciting in the market of DeFi and DEX.

Newcomers to cryptocurrencies in particular place a high value on convenience. In the beginning, trading and choosing the right centralized platform can be very beneficial in the long run.

In such a case, it is a good idea to start with a reliable, multi-certified platform. A simple interface makes trading relatively easy.

These are just a few advantages you will get with Bityard. Just try it out and see for yourself the above-mentioned advantages.

8. NFTs—Non-Fungible Tokens

NFT stands for Non Fungible Tokens. These are unique cryptographic tokens that are non exchangeable and currently one of the hottest blockchain trends around. These tokens represent a unique value. They are a singular asset.

The most successful NFTs are the ERC tokens, and they can be traded on marketplaces like Decentraland, Opensea, Enjin, Rarible, or SuperRare. Even though some critics believe the NFT market is overvalued, there are already many successful circulation projects.

These include, for example, works of art, antiques, and collectibles such as the figurines from CryptoKitties. Digital assets, including videos, audios, or digital art, can be released to certain users or groups with tokens. One project I can recommend to you is the Superworldapp! SuperWorldApp sells virtual land, where you could also place your advertisement. Furthermore, you can record an information video about a friend’s area, for example, in San Francisco at the Golden Gate Bridge. When the friend is standing at the Golden Gate Bridge, the video will appear, and you will get a presentation about the Golden Gate Bridge.

Superworldapp is the Monopoly of the 21st century! A combination of VR and AR. Superworldapp has 64billion NFT’s, and as you probably already know, 2021 will be the year of NFT’s. More NFT’s were sold in February 2021 alone than in all of 2020.

9. Tokenization of bonds—STOs

STOs are Security Token Offerings, an event where digital securities are available. After crypto-tokens, security tokens are considered Blockchain Trend 2021 because they are fully regulated and represent digital assets that comply with securities regulators’ basic regulations.

The offerings are securities that have been approved by the authorities and are therefore also subject to the prospectus requirement, which must clearly state the funding objective.

This is because they involve financing rounds in which equity or debt capital is to be generated. They may be carried out by any company that complies with securities regulations. STOs, give the buyers a share of the company’s profits in return for the loan they extend.

Compared to traditional investments, however, STOs offer significantly higher returns and interest rates, making them particularly attractive to investors. You do not have to give up the usual securities of classic investments and rely on BaFin’s catalog of requirements for German STOs.

The immense potential for the next few years is likely to lie in the fact that STOs do not require intermediaries’ assistance. The much leaner structure, therefore, offers greater profits. Besides, this process allows mid-market companies to access funding, as forming a public company is unnecessary for STOs.

10. More crypto investment vehicles

Crypto funds are always semi-regulated, but another business model can be interesting if you want to choose between semi-regulated and fully regulated.

Investment vehicles offer professional investors diverse fund strategies. Investment vehicles are a kind of generic term for investment products such as real estate or equity funds. The crypto investment

vehicles are also called funds-of-funds and bundle the regulated crypto funds into investment vehicles.

Soon, the F5 Crypto Fund will also be the first open-ended crypto fund registered by BaFin. Therefore, crypto investment vehicles are one of the most important blockchain trends in 2021.